The Deceptiveness of ESG Funds

ESG funds have been under scrutiny lately with allegations of greenwashing and calls to reform the entire system. Part of the problem is a lack of regulation around ESG ratings. Many investors think a fund with a high ESG rating must have high impact—after all, it did get a good rating. However, these ratings aren’t all they are cracked up to be.

Ideally investors could select from a range of ratings providers, openly publishing their standards to find those that align with their values. But that’s almost impossible to do when these institutions don’t make their scoring guidelines public.

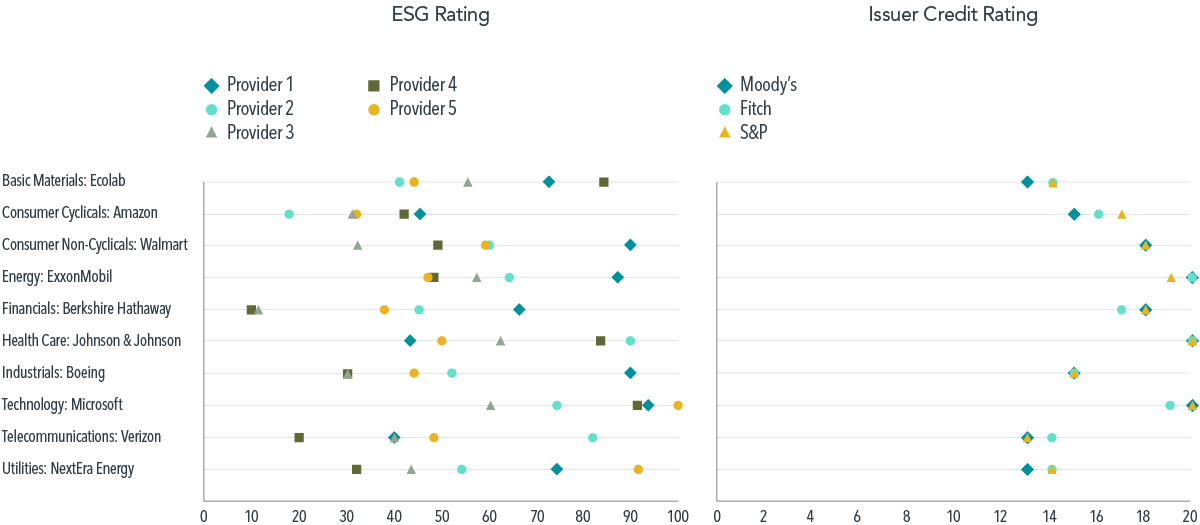

In the graph below, you’ll see the spread of ESG scores from 5 different rating providers and the spread of credit scores from 3 major institutions. For the ESG scores the same companies have very different ratings but the credit ratings are very close, if not the same.

Why is there such a discrepancy in ESG ratings versus credit ratings?

Credit ratings apply a standardized formula to determine a company’s creditworthiness, while this may have variance from each ratings institution, they are all closely in agreement on the major factors—which you can see from the spreads below. However, ESG rating methods are not standardized or regulated—a key flaw with the current system. So, you end up with huge inconsistencies between ratings providers for the same company—notice the much larger spreads in the graph below.

Will Collins-Dean, “Do ESG Ratings Get High Marks?” Dimensional, October 26, 2021

In some cases, these discrepancies are explained by one factor: whether the ratings organization sees the company as a leader in ESG investing or a laggard. For example, let’s look at NextEra Energy, a leader in that they are a large investor and innovator in American renewable energy. But looking at the scores above, only 2 institutions consider them a leader in ESG investing and 3 place them in the average category. Why? Because the ratings agencies’ values are misaligned with those of values-based investors.

Henry Fernandez, chairman and CEO of MSCI—one of the largest ESG ratings providers—said that he knows ordinary investors have no clue how MSCI’s ESG scoring works. Bloomberg Businessweek dug deeper into MSCI’s ratings, finding that their evaluation method didn’t actually look at a company’s impact on the world surrounding them, but rather, the score is reflective of the impact the community has on its shareholders. For example, one of the cases looked at water stress and found that the score was determined by how much water the community could make available to a company’s operations, rather than how much water the company was using. Bloomberg also found that many rate increases in the governance pillar were given simply by implementing policies banning already illegal actions like money laundering. This resulted in 90% of the businesses in the S&P 500 being included in ESG funds.

Some of MSCI’s largest clients are the financial institutions producing the ESG funds that MSCI then scores. You can do the math here; is a ratings system that’s ambiguous to investors and profits from the funds it scores going to provide objective information?

Impact investing is not easy to do well, in part because of a lack of regulation and transparency around ESG funds makes it harder to align your portfolio with your values. That’s why many prefer a customized strategy, which is what we provide at Camelotta Advisors. We help clients identify the kind of impact portfolio they want the participate in, the issues they want to support and create a customized strategy to fit their needs and goals.

Copyright 2022 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...