Investor Commentary Q4 2024

Key Takeaways:

- Another double-digit year for stocks: broad-based rallies to a more selective and discerning market environment leaving us in a narrowing “trader’s market” especially around the AI theme.

- What effect could the election result have on the economy and investors? The new administration will have to negotiate with Congress and markets.

- The way forward: what’s our prognosis for stocks and bonds in the coming months and years?

The financial landscape is evolving, shifting from broad-based rallies to a more selective and discerning market environment leaving us in a narrowing “trader’s market” characterized by stark contrasts between winners and losers. Within more “traditional” technology, some investments have seen significant losses over the last year.

Indiscriminate rallies—particularly in the AI sector—have begun to fade.

Early enthusiasm mirrored the dot-com boom, with everything AI-related skyrocketing. Now, we’re seeing the emergence of clear winners and losers. For example, companies like Broadcom and Reddit are stepping up as potential power players in the AI space, while others like Adobe struggle to maintain relevance. In the automotive space, Tesla (which we count as a tech stock) has been a standout performer this year, while other U.S. carmakers have lagged.

The biggest story last quarter was the boom in certain asset classes after the election under the narrative that Trump’s administration would stimulate growth through lower regulation and higher capital spending while also tipping the scales in terms of certain winners that align with his interests and crippling those he will push out of favor, especially in the domain of clean energy. This led to a rally in assets that the market believed would benefit from these policies. However, at the time of this writing, most of that rally has faded perhaps out of a realization that campaign promises are more easily said than done.

Major tax cut extensions may prove difficult to pass given the dire state of US public finances. Other Trump policies may be politically constrained by tight governing margins in the House (as evidenced by Trump’s failure to push the debt ceiling in December), the enduring presence of the Senate filibuster, and some Supreme Court decisions over the summer that constrain executive rulemaking in favor of Congressional legislation.

The bond market also presents a formidable hurdle. Inflation will elevate if we impose tariffs against an already scarce goods market, enact severe immigration restrictions in the face of a tight blue collar labor market, and run massive fiscal deficits (extending the Trump tax cut) that stimulate demand. In bond math, inflation is a direct addition to base bond yields, therefore, such policies could easily lead to higher interest rates. Worse yet would be if it triggers the Fed to make a U-turn and begin raising rates to stanch out inflation. This is why I believe the bond market and Fed will have a “vote” in whether Trump can realistically execute on his agenda.

Globally, the contrast between the U.S. and the rest of the world has rarely been starker. As American investors, it’s easy to forget that we are enjoying exceptional economic performance and stand as the only major market making money. Across the globe, other economies are grappling with significant challenges. Germany, for example, is struggling with infrastructure issues due to insufficient debt, leaving critical public services underfunded. France, on the other hand, faces political instability tied to its excessive debt levels, which have exceeded EU targets, forcing painful cuts. Canada, among the most indebted nations globally, recently lost its finance minister and Prime Minister over disagreements about additional spending. Compounding these issues is the uncertainty surrounding potential U.S. policy changes, such as new tariffs or currency controls, which could add pressure to already strained global markets.

Perched at the beginning of 2025, memories of the year 2022 are beginning to seem rather distant. However, that was a recent year that stood as one of the worst for investors. Of course, that was answered by two subsequent years in which the S&P 500 returned more than 20%—a rare performance not seen in decades.

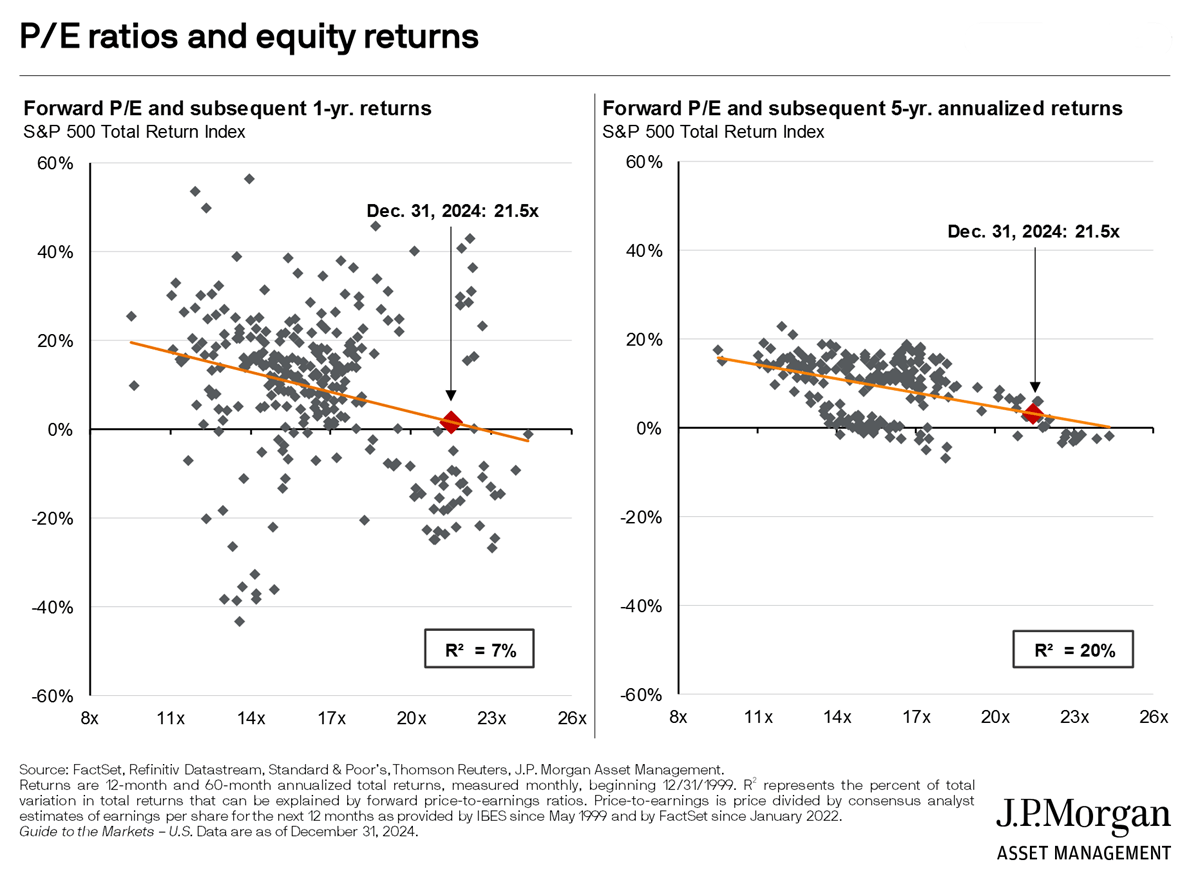

Each quarter of 2024 saw a lower S&P 500 return than the prior (11.24%>10.16%>3.92%> 2.07%). Will this trend continue? We believe it is likely based on the three major ways of thinking about stock valuations. The first is the ratio of prices to earnings. The current number, 21.5, is more than one standard deviation above the average of 17. The past two peaks (before selloffs) were at 25 (dot com) and 23 (just prior to 2022). Assuming flat earnings, an expansion to 23 or 25 would see the S&P 500 rising between 7% & 16.3% from here. But this may take longer than next year.

“P/E ratios and equity returns: These charts demonstrate the historical relationship between forward P/E ratios and subsequent 1 and 5-year returns. This slide shows that while starting valuations do not necessarily have predicative power over short time periods (1 year), they do provide information about longer return periods such as 5 years.”

-Slide 6, JP Morgan Guide to the Markets.

For a clue to the next 12 months, the following graph shows that the average return at this price level is 1.50% with the 5-year average total return at 7.73%.

From these two data points, we can infer that near-term rises will range between 1.5% and 3%, which are all lower than its performance over the past two years. This is a strong case for maintaining the fixed income side of your portfolio.

Second, we can look at capital flows. This is a measure that we track for both the Federal Reserve and central banks around the world. On this measure, we can see that capital flows have been flat in the past quarter. Our measure of bank lending is also flat. While this is no crystal ball, it would lead us to believe that the next 12 months might bring more moderate returns. Although we don't see any signs of a major pullback, we look for catalysts that could shock markets against this very neutral backdrop. Sentiment, the third indicator, is universally bullish and is a contrarian indicator (meaning you should sell when everyone else wants to buy and vice versa). The abundant bullishness is likely due to the “everything rally” of the past couple of years causing many to forget that in an average year, the S&P 500 experiences a dip of 14% (which we call drawdown) before going on to profit. We must ask ourselves how we would feel experiencing a 14% downward swing as the cost of eventually making money.

Copyright 2025 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...