Investor Commentary Q2 2024

Takeaways: Putting 2024 in Perspective

- The first half boom stalled out over worries about inflation, debt levels, and the possibility that the Fed will keep rates high for too long.

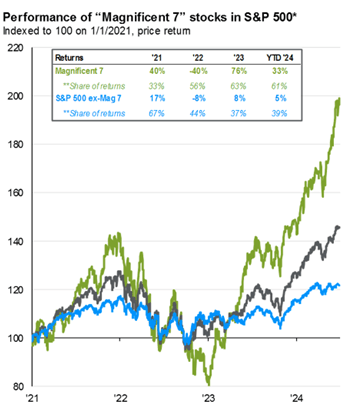

- The one bullish narrative centered around AI, specifically one company that seems to be capturing most of the spoils: Nvidia. Those who owned the S&P 500 benefitted as this stock lifted the index to a 3.92% return ahead of the -0.92% return to the S&P 500 equal-weighted index. International, fixed income, and commodity indices ended with modest gains.

- As investors, the big questions are: is valuation outmoded, i.e. does expensive beget more expensive? Also, time frames matter: will AI benefits to the economy manifest before or after the next recession? Lastly, we can’t ignore the mountain of debt about to reprice at higher interest rates facing real estate and most importantly, the US government.

At the conclusion of the first half of 2024, risk markets wavered between the promise of applied artificial intelligence (AI), set against economic headwinds of inflation, higher interest rates and debt worries across the economy; particularly in real estate and, surprisingly, at the US Treasury.

As a result, we saw a tale of two markets: half of the return to the S&P 500 this year comes from just five stocks with Nvidia accounting for over half of that. The thesis behind Nvidia is that the artificial intelligence boom will be a major boost to corporate performance. However, the question remains whether the spoils will accrue to this one outstanding company.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management, Guide to the Markets – U.S. Data as of June 30, 2024.

The magnitude of the rise defies superlatives. In a single day, Nvidia's value grew more than the entire value of Tesla.

However, I think we would be remiss to ignore the message implied by the other 495 stocks’ performances. While the S&P 500—an index which weights stock based on their market capitalization—is up 14.8% YTD, if we equally hold all the companies this gain falls to 5%, which means that returns are concentrated in about 1% of the stocks in the market.

Why not just hold these top seven companies and do away with the diversification? The reason we don't is because investors always look forward. We cannot say whether they will exceed the massive future growth already embedded in their prices. On the other hand, perhaps these stocks will pause while other sectors, which are relatively undervalued, rally to catch up.

Beyond domestic equities, investors profited from diversifiers. For example, gold, silver, and base metals like copper have positioned commodities as our biggest outperformer and of course, there are laggards—those that aren’t giving us as much diversification as we would like. We are focused on whether these remain unique as asset classes, which, like pistons in an engine can rise when others fall creating a positive net result.

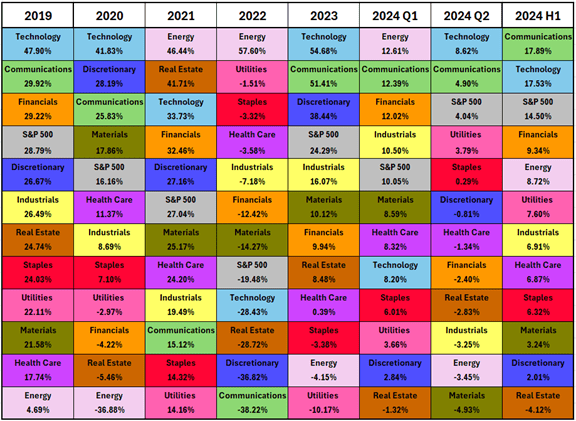

The graph below shows us how sectors take turns rotating towards the top.

In today’s market, one remarkable trend is the low cost of portfolio insurance against a market crash. I believe this “portfolio insurance” is facing stiff price competition from a surprising actor, the Fed. Simply stated, there is a belief that the Federal Reserve will bail out market participants if there is a major drop. Why buy insurance when the government—being the ultimate risk manager—gives it to us for free? At my Harvard Business School reunion in 2010 one of my finance professors told me that one of the lessons of the financial crisis is that you should always buy insurance when it's cheap or free. Accordingly, we are evaluating whether to add this insurance. This would respect the message conveyed by the other 495 stocks; that there is a tremendous risk of a recession and repression caused by the inflation that's still out there. Still? Didn’t the inflation data last quarter show almost no growth? Yes, however while the growth has attenuated, let us not forget that the level of prices in the American economy stand at 20% above the levels when Biden was elected. A significant increase in expenses is on many minds and we will find out if this is a big enough issue to affect the election. Whatever the case, post-election, the mandate to keep prices low will ease leading to less support and greater challenges for investors.

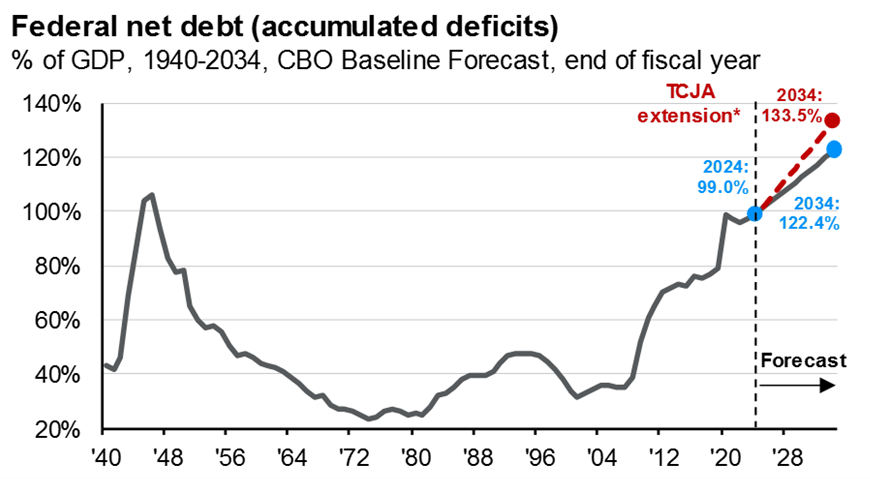

You may see the question of indebtedness becoming another headwind for the US economy. To give you a feel for the debt problem, consider this: US public debt—meaning, on behalf of all citizens at the governmental level—has quintupled in the past 15 years. The total debt amassed exploded starting with the 2008 Global Financial Crisis (GFC) followed by Covid-19 relief spending.

Source: J.P. Morgan Asset Management; BEA, Treasury Department. Estimates are from the Congressional Budget Office (CBO) June 2024 An Update to the Budget Outlook: 2024 to 2034. Guide to the Markets – U.S. Data are as of June 30, 2024.

This is a distinct risk to savers and investors because there are no good ways to pay this bill. Raising taxes is politically unpalatable on both sides of the aisle especially if the alternative is to print money—which is the second and most common solution. However, this option would push inflation much higher than anything we have seen in our lifetimes.

Lastly, we could dramatically cut the size of government, but most spending is for defense and entitlements, both of which are untouchable. On top of that, it would dramatically reduce the US GDP.

The risk of not addressing this issue is that interest rates could spike due to forces beyond our control. Bill Clinton’s chief strategist James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” Historically, bond vigilantism has resulted in economic shocks that can lead to political turmoil and a drastically lower standard of living.

The tale of this year is really the first quarter as this was a quarter to forget with most assets showing milquetoast performance.

Copyright 2024 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...