Investor Commentary Q2 2022

Key Takeaways:

Putting 2022 in Perspective

- Over the past 2 years, we enjoyed a huge increase in values. The “cost” of admission to this type of performance is the acceptance that markets like the S&P 500, have dipped 14% once a year on average. While things are down, investors don’t truly lose money unless and until they sell out of the market.

Focus on the Probable, Not the Possible.

- There’s a tone in the press indicating that “the worst is yet to come.”, i.e., things could get worse from here, but this is not likely. If we rank this year’s first half against any rolling 6-month period over the past 100 years, this one falls in the bottom 3—meaning more than 97% of the time you would have done better. Successful investing lies, in part, in taking risks when the odds are in your favor. It is more likely that the next term will look closer to the average –improvement – than that the market will fall to Great Depression or WWII levels.

The pandemic broke the economy, causing major financial displacements. Markets dislike uncertainty, yet participants were fed a heavy diet of doubt. Inflation looked to be the issue, but this quickly turned to recessionary fears evolving into a feared credit crunch especially affecting real estate; none of which is good for corporate profits or credit availability. Market players have never seen such a rapidly changing narrative creating uncertainty around the correct price for all assets.

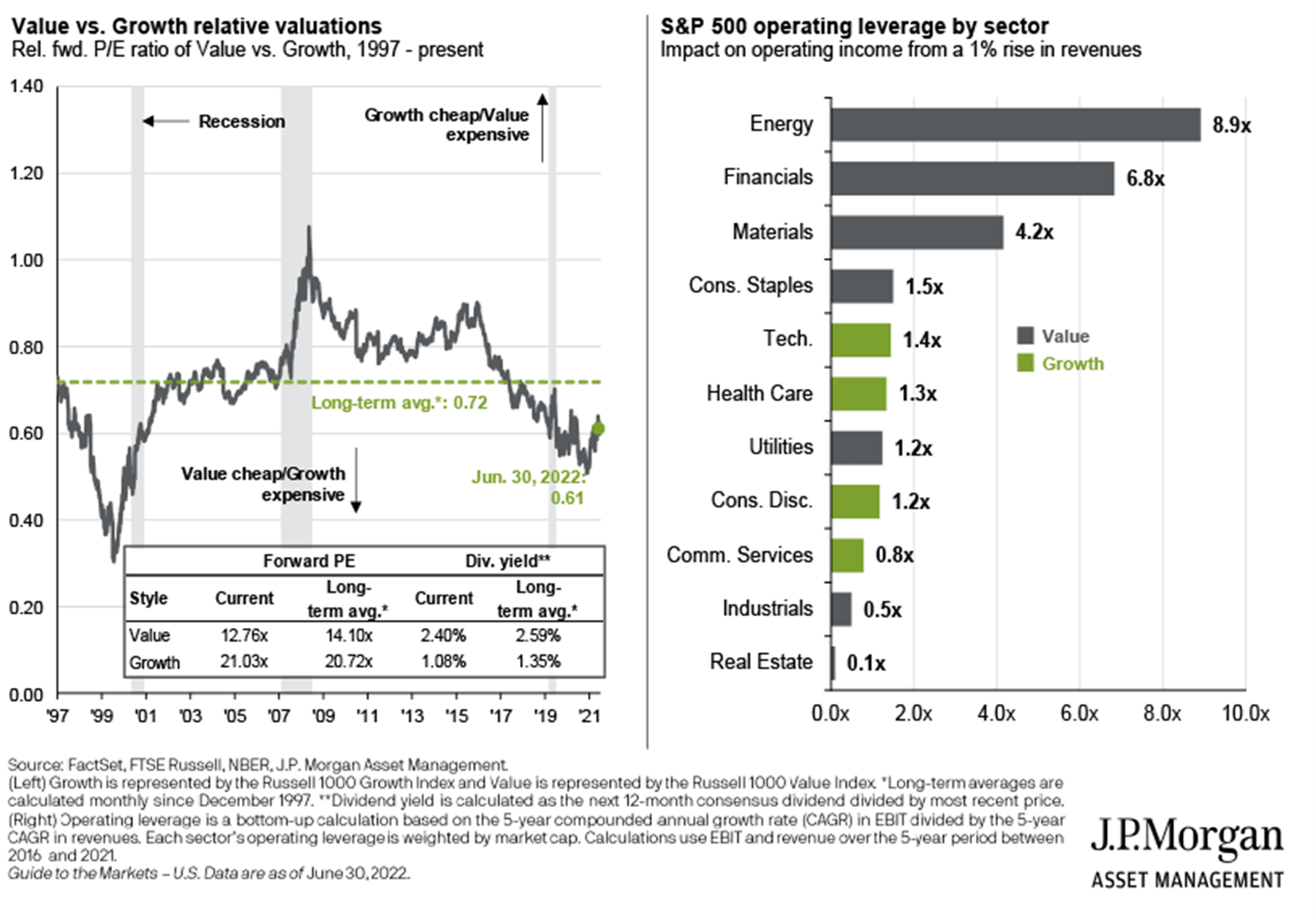

Growth stocks led the declines last quarter at -28.10%, while the S&P 500 lost in all sectors averaging out at -16.45% concluding its worst first half in 50 years. Even commodities, this year’s big gainer, dropped 4.39%. Ranking the past 6-months against any rolling 6-month period during the past 100 years puts things into an interesting perspective. Bonds had the second worst performance of the past 100 years. For the stock market, it falls in the bottom 5 only surpassed by WWII, the Great Depression, the Dot Com Bust, and the 2008 Global Financial Crisis (GFC). As far as diversified portfolios, this is only the fourth time both stocks and bonds were down two quarters in a row. Only once were they both down three quarters in a row.

So, what’s going on? Our belief is that this reflects massive uncertainty around where assets should be priced relative to the rest of the economy. The big idea for investors is that the extremities of the first half of 2022 were exceptional and it is highly unlikely they will happen again in the second half. Rather than focusing on what occurred and concluding that the worst is yet to come—which is possible, we are playing towards what is probable—that things will improve. Historically, diversified portfolios recovered fast. All 60% stock and 40% bond portfolios recovered their losses within 2 years; even better if they employed tactics like our sector investing.

The lesson here is that the worst of times in the headlines was the best of times for investors. Moreover, most of the gains were obtained during a mere 10 days out of a 200-day trading year. The conclusion: it hasn’t been wise to sell to cash to “wait it out” because you will likely miss the opportunity to recoup losses.

Inflationary bubbles always end, our research into the past 100 years of US inflationary episodes yields some interesting insights. First, we noticed that although stock markets dove as inflation rose, they recovered faster than inflation and rebounded strongly just as inflation reached its worst levels. So, when the outlook was bad and getting worse, stock markets rallied. We all remember two years ago when, to the astonishment of many, the stock market went on a strong bull run just as the Covid story was of ever worsening unimaginably bad virus situations.

Once fair value is established new market leaders will emerge and eventually steer markets higher. For example, take the inflation narrative; all assets in a capitalist economy can be valued based on two basic factors: growth and profitability. Inflation plays into this by reducing the amount we would pay for either of these items because it devalues future income, thus magnifying the impact of current income.

This is why growth stocks, led by tech, declined more than the rest of the market last quarter. In other words, all business or assets are worth less in a high inflation economy however the more a company relies on potential growth the more it devalues against companies that rely on the proven value; think about whether growth-oriented Netflix can produce the next hit vs. whether Procter and Gamble, a blue-chip value stock, can sell diapers and toothpaste. Moreover, if inflation results in increasing prices, some businesses can even take advantage this to earn more. Energy and oil companies are the biggest example of this rising by 25% this year versus a drop of 20% in the S&P 500. Without energy, the index would have fallen by 23%.

Copyright 2022 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...