Investor Commentary Q1 2025

Key Takeaways:

- Fasten your seatbelts. Markets react to uncertainty by exhibiting higher highs and lower lows which may feel catastrophic but presents opportunities to profit for those with the stomach.

- Beyond tariffs: the market is a leading indicator for deeper economic problems.

- Position for this new environment using advanced portfolio management processes. You can help by sticking to your financial plan, particularly the budgeting piece.

Uncertainty is the defining theme, with the dominant path of strong growth forking into 2 more trails called recession and stagflation. Looking at the data, the economy looks strong. Growth in GDP is still expected to be some of the highest in the developed world. Inflation is still a threat but in aggregate has moderated (albeit at much higher price levels that are not rising as fast as they have been, which is called disinflation).

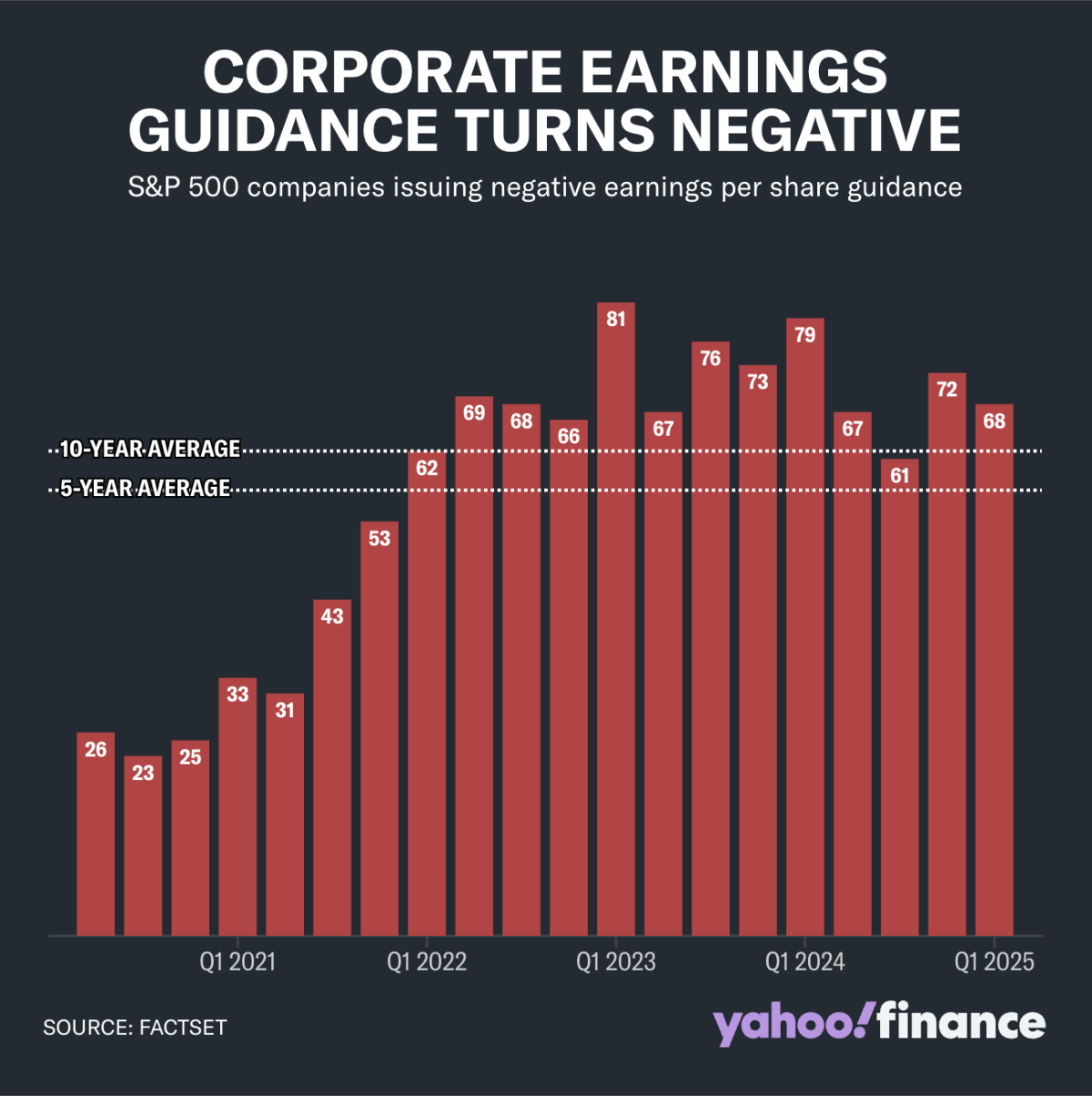

However, last quarter, markets looked ahead at threats from inflation and potential stagnation because of tariffs, prices, layoffs, and their interplay with corporate fiscal and consumer finances. Businesses crave stability in their costs and customers. If inflation, tariffs, and wage pressure place uncertainty on their cost lines, they can only plan for the short run and will go with the worst-case scenario in the longer term. This contrasts with the optimistic business outlook of the past few years. Accordingly, lower earnings estimates reduced the value of stocks.

The S&P 500 lost 4.59%, its worst quarterly performance in 3 years. Ostensibly, it sold off due to tariffs and geopolitical uncertainty, but this isn’t the whole story. There is a deeper and more troubling dynamic if we think about the stock market as an actual market of stocks. In other words, what companies did the losing? In that, we learn that the AI led magnificent 7 stocks showed distress out of scale with their exposure to tariffs etc. These stocks declined almost double that of the rest of the S&P 500. Looked at another way, industrials, presumably in the bullseye of tariffs, lost almost nothing at -0.50%. Tech lost almost 16 times as much, down 8.30%. Is this merely a cooling on the already stretched AI trade or is it a bellwether of deeper fissures in the economy? For short-term guidance, we watch technical indicators, this helps us know how to deploy new cash etc. I was shocked to see that technical analysts are alert to the idea that we might be seeing something called a “bear flag” in the S&P 500. If that is the case – and the data is still out – they believe the broad market could drop another 10% from here. We don’t have a crystal ball, but all this goes to say that the risk of a selloff at some point is higher.

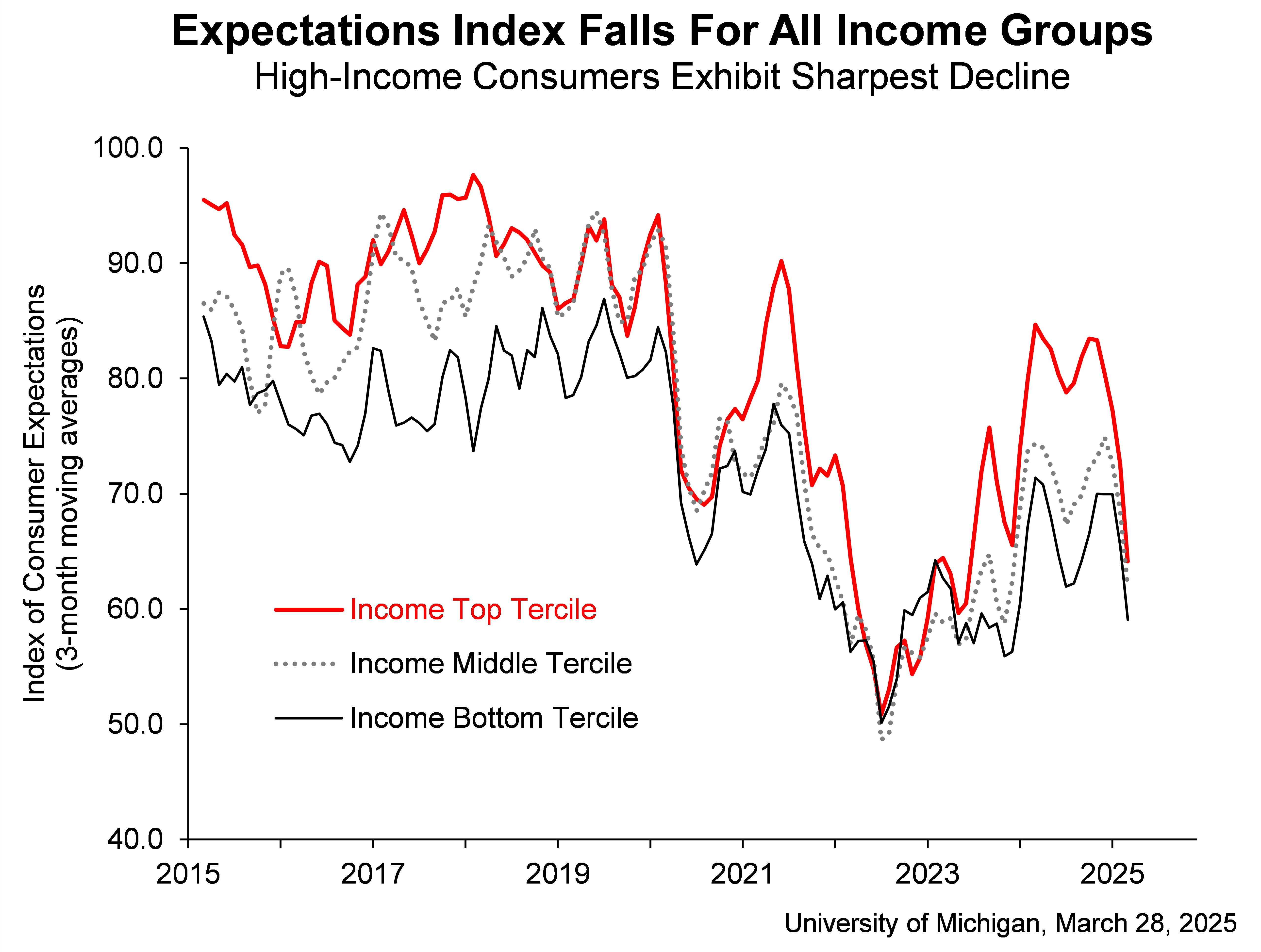

What else is going on? We see a worsening of sentiment from consumers and businesses. This is problematic because 69% of the US economy is driven by consumer spending and 17% by businesses. As for the consumer, she is beleaguered. If we look at spending by segment, we find a remarkable phenomenon. Lower- and middle-income folks are highly indebted – maxed out – and facing the brunt of higher food and housing prices, so their spending has flattened. As the old saying goes, “the rich are different,” the small number of high-income households has emerged as the driver of consumer spending and, therefore, 2/3rds of the US economy. Unlike the other 2 segments, this group depends on stock market gains to drive their income and confidence, which hinges on the business outlook. Flagging fortunes compounded by anxiety about the geopolitical climate is triggering them to defer or reduce their spending which creates a downward cycle as businesses react by retrenching.

Some investors took comfort the past few years in the conventional belief that, if the market sells off, investors would be saved by one of two “put options” created by President Trump and the Fed. To reiterate, a put option when in effect, allows you to sell a low-priced asset at a higher price. As for the Trump put, he indicated through his Treasury Secretary a belief that stock corrections were healthy. So, this might be a long time coming. The other put from the Fed is tricky because the Fed would have to lower rates in order to bail out investors but that would only stoke inflation. This is especially untenable in light of arguments that the current nagging and persistent inflation problem was created by Fed efforts to help investors during the Covid-19 crash five years ago. Many now see this and similar action as a policy error energizing the current divided political climate. Unemployment would also cause the Fed to lower rates, but the last unemployment report looked pretty good. As I said on NBC Bay Area in February and March, the current employment report did not include the DOGE effect, which we will see in April’s report. If that shows that businesses have stopped hiring because of uncertainty, consumer and business sentiment could erode further propagating the chain reaction towards flagging equity markets and recession.

In conversations I have with clients and the media, two basic questions emerge: first, how is Camelotta dealing with all of this? Second, is there anything our clients should be doing in response to the current economic climate?

In past years, we wondered when international equities would start to add value and last quarter, at 4.59%, it took the crown as best stock class. It's taking off because suddenly G7 leaders are realizing they might have to defend themselves militarily and therefore, they have begun spending money preparing for war. This boosts their corporations’ earnings. As for commodities, gold gained 19% and even bonds gave us a 2.61% plus solid stable income.

As for investing: focus on maximizing dollars over percentage returns. The aim being to have more money at risk in upward cycles and less in downward turns. Does that mean one can see the downturns coming and pull out? Of course not. But rather, aim to reduce exposure to down markets (losing less) to have the cash and skill to put more money at risk when the upcycle returns (make more). In an up and down cycle with a percentage return of zero, the aim is to show income that is greater than zero.

Beyond this, for clients, we bring a level of expertise not normally found in the domain of financial advisors, but my background is rare amongst my peers and leaves me in a position to set us up for success. Around the office they say, “let Dana cook!”

What can you be doing? I’m often asked, given all of this – the concerns, market corrections, and uncertainties – should I make changes to my spending habits? Now more than ever it is important for you to stick to your budget and save as much as possible, ideally, against a solid financial plan as we provide to our clients.

We thank our loyal clients and followers for all of their confidence in our work during these volatile market conditions.

Copyright 2025 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...