Investor Commentary Q1 2024

Takeaways:

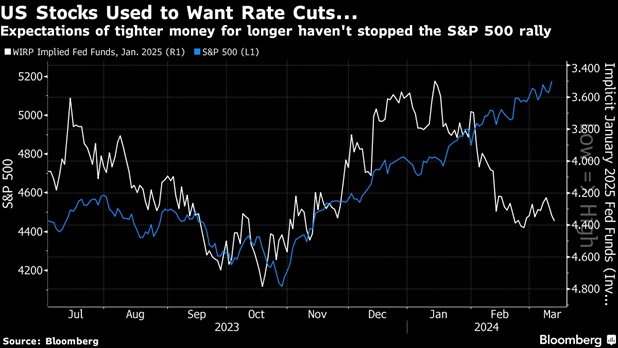

- A quarter defined by divorces: we saw a few important relationships break down with profound implications for the economy and markets. Most notably, interest rates broke their negative correlation with stocks, and we saw rate expectations rise along with markets.

- The Fed softened their emphasis on a 2% inflation target and instead focused on continuing to promote the ever-growing economy. This growth was real—i.e. not inflationary—as productivity and consumer sentiment looked positive.

- The anti-aging economic cycle moved in reverse: recessionary fears of a year ago reverted to a late-stage expansion only to accelerate into early-stage growth.

- For markets, liquidity from the Fed has taken a back seat to valuations and positive sentiment. This, in conjunction with the “reverse cycle,” sparked rallies outside of the former leaders—the “magnificent seven.” In fact, the S&P 500 rallied 10% in spite of its largest company Apple falling 10%. The thesis around AI and Nvidia was strong, however there were mundane retail stocks that did even better. Risks to this rally come from the real estate and financial sectors. Highfliers risk the fate of Sisyphus.

The magnificent seven stocks, defying an earnings recession and higher interest rates, defined 2023. As the year turned, they left center stage leaving a wide array of the remaining 493 stocks to have their turn. How did we get here? Via a long and winding road. The driver was economic growth which is in a race with the nightmare of inflation. Last quarter’s inflation growth readings pointed towards stabilization between 2-3%. The Fed was surprisingly content with this range abandoning their prior “2% at all costs” dogma. Perhaps they saw the first of our three remarkable shifts, a doubling of productivity growth leaping from 1.6% to 3.2% (see graph below). This matters because productivity is a cooling agent for inflation; it results in growth accompanied by a lower rise in prices, meaning everybody is getting richer in terms of what they can buy. Such growth occurred before the massive investment boom in artificial intelligence (AI), which adds to it. It helps that these productive jobs are plentiful: unemployment has been under 4% for 2 years. Travel, retail sales, and restaurants are booming. Cocoa, the stock market, and housing prices are at all-time highs, leading to the highest level ever of household net worth. The US is currently the richest country in the history of the world.

Change in Labor Productivity Output per Hour

Source: US Bureau of Labor Statistics, “Major Sector Productivity and Costs,” Series ID: PRS85006092.

Such viral growth enabled the Federal Reserve to step back and let economic growth continue running on its own and raise their predictions of forward interest rates. This crystallized an interesting phenomenon. Since 2008 and the Global Financial Crisis (GFC), higher rates, in the form of less money printing, fomented lower markets. But this time is different. Stock markets and other risky assets rose on the news of higher interest rates. What seems paradoxical at first is a healthy shift and many forget that this is the historical norm. Looking back at the last hundred years, it is normal for economic expansion to lead to rising interest rates. When economic activity increases, the demand for money should go up; with interest rates being the price of money, higher demand should increase this price. This is the second sea change in last quarter’s economy and markets. This is great for the Fed because it enables them to exit an uncomfortable role as the driver and kingmaker in global economies, allowing the invisible hand of free markets and capitalism to determine prices and resource allocation, which is extremely healthy on a lot of levels.

Equity markets reached new highs as we ended the quarter with the S&P 500 rising 10% in its first back-to-back double-digit performance since 2012. Of the magnificent 7 stocks, which drove Q4, this rally came in spite of the largest company, Apple, falling 10% and Tesla falling almost 30%. Saving the day were the other 493 names, which averaged a solid 6% return with the energy and financial sectors outperforming.

What about Nvidia? I listen to the Nvidia earnings calls and find it interesting that their CEO asserts that they are the only firm that can capture the “shovels” aspect of the coming AI boom. Perhaps proving him right, out of 15 stock picking funds based around AI, only 3 have outperformed the S&P 500 meaning Nvidia stands out even within the AI world. That said, the big questions are what is the right price given their prospects and by extension, is the 7% of our S&P 500 allocations the right amount?

Performance, like time is relative. Abercrombie and Fitch, a consumer discretionary firm, outperformed highflier Nvidia by 100% over the past one-year and two-year time frames. Orthogonal businesses lines that have only one thing in common: both companies are well managed with a clear value proposition. It’s no surprise, as this has always won the day and is the secret to winning investments.

With Nvidia approaching a P/E ratio of 75, we should ask; are we in bubble territory? The Economist ran a cover story saying yes and it was likely to crash. We never know until afterwards, however we can look at some simplistic measures. Earnings multiples at 21 are higher than their average of 17 but lower than the 25 we saw in 2000. On the other hand, tech valuations stand at their 2020/2021 highs around 28, with energy and financials far below at 13 and 16 respectively.

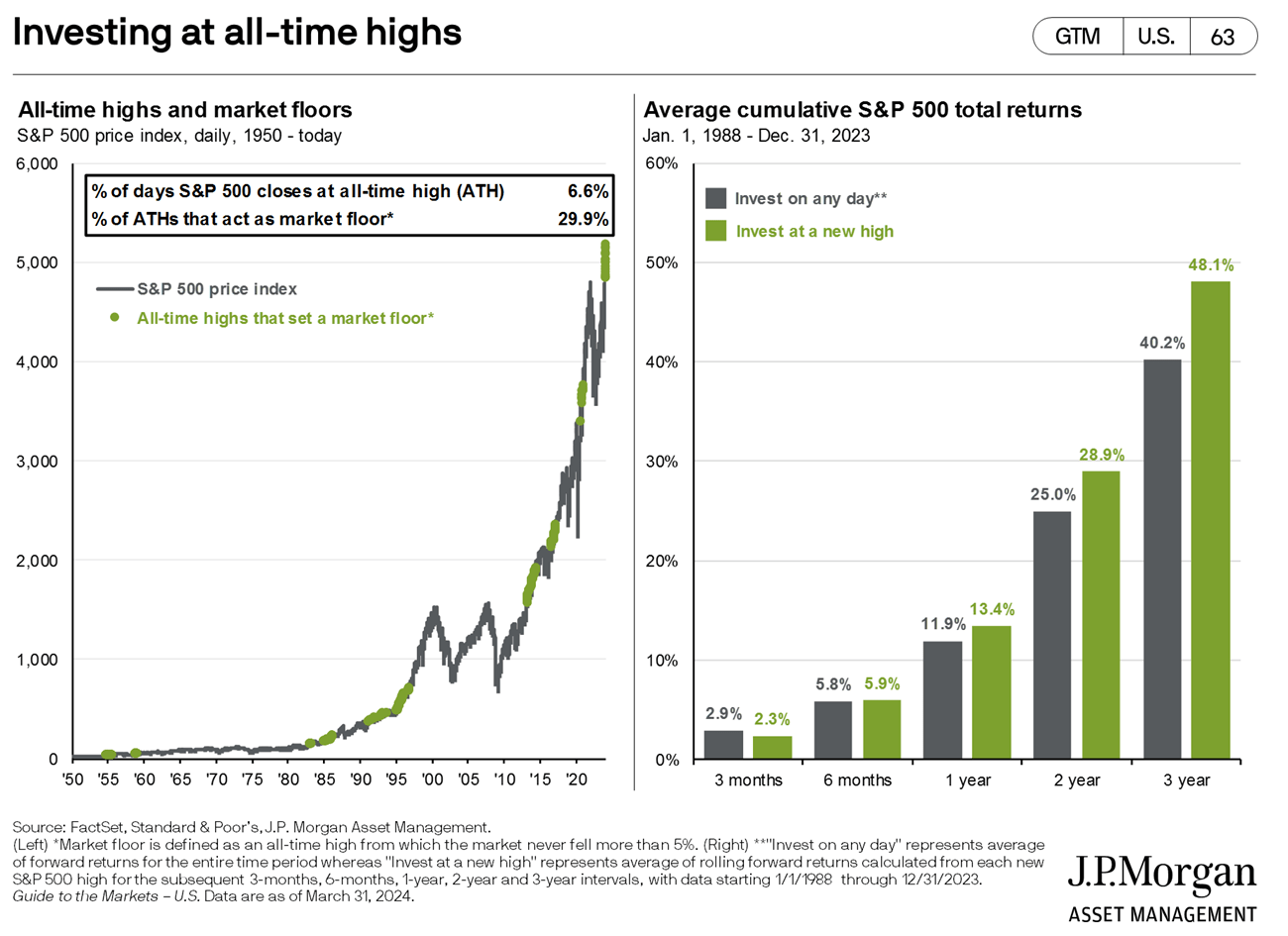

Although the past is no predictor, we can reframe the question and ask whether we have in fact formed a new floor or base at current levels?

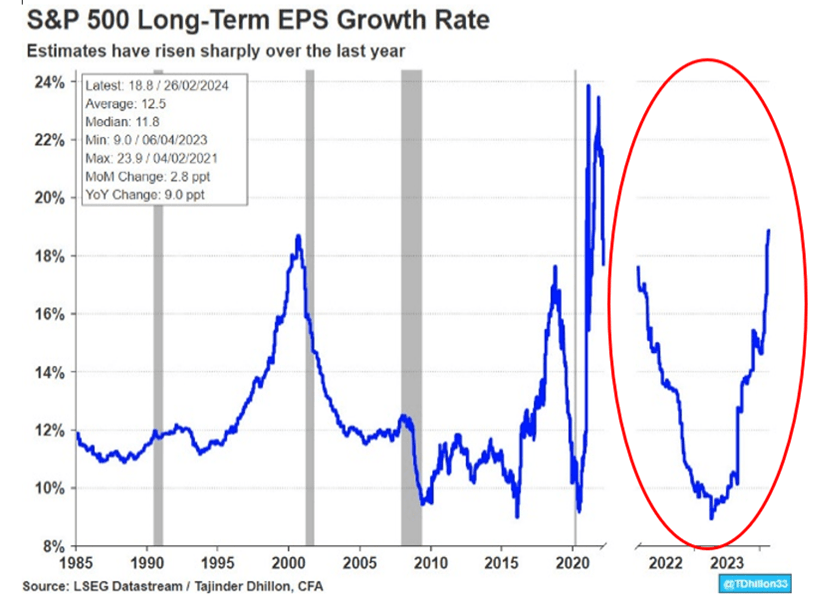

The big question is whether corporations will reflect the booming economy in their earnings growth. Lowering the bar is the surprising fact that the S&P 500 has just emerged from a yearlong earnings recession which constitutes our third major shift.

If the strong economy energizes corporate earnings, then current market levels are justifiable but certainly we want to notice broad “misses.” Let us not forget that higher interest rates lower the value of earnings. Therefore, we must also maintain a vigilant eye on the opposing forces of inflation and growth which will settle the level of interest rates and consequently, investable assets.

Major shifts trigger a re-sorting of winners and losers. Rising interest rates imperil two lines of business: commercial real estate and financial institutions. Commercial vacancies, especially in business districts colliding with a wave of loans refinancing at higher interest rates will stress landlords. Many of these loans are held by banks which are also dealing with the “new normal” of 5% yields on their savings accounts. Savings accounts are liabilities on bank balance sheets offset by income from loans and bonds. During the Covid-19 lockdowns, the Fed printed money and stuffed it into banks, which in turn bought bonds when Treasuries were yielding around 1%. In simplistic terms, earning 1% and paying 5% doesn’t scale well but this is the reality faced by a huge swath of the global banking and insurance sectors. It reminds me a bit of the issue the Savings and Loans faced back in the 80’s during the S&L crisis (yes, I was a kid, but I still read the financial news) and we know how that ended. Nascent stress in the system took out New York Community Bancorp last quarter. Don’t be surprised if we see another bank failure. However, as we saw last year, even bank failures aren’t enough to pull the steam out of the freight train that’s pushing our economy forward.

We are riding a tiger right now, doing everything to make sure that we stay on top of things. Maintaining diversification—losing less to win more—is the right position for those wishing to build wealth over the long-term.

Copyright 2024 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...