Investor Commentary Q2 2023

Takeaways:

The story behind the story: last quarter’s performance was attributable to fewer than 10 stocks. If we strip them away, the markets tell a different story.

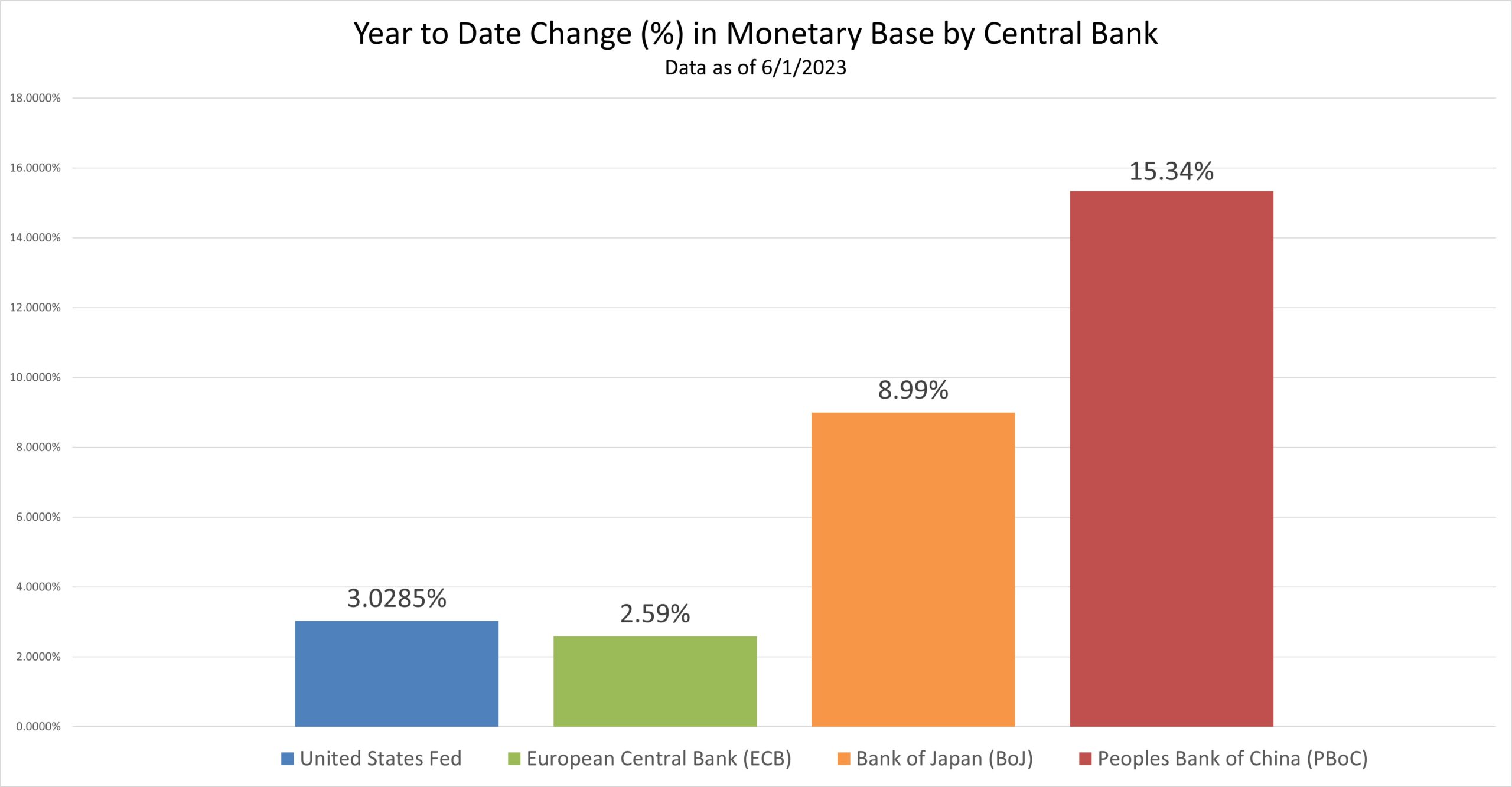

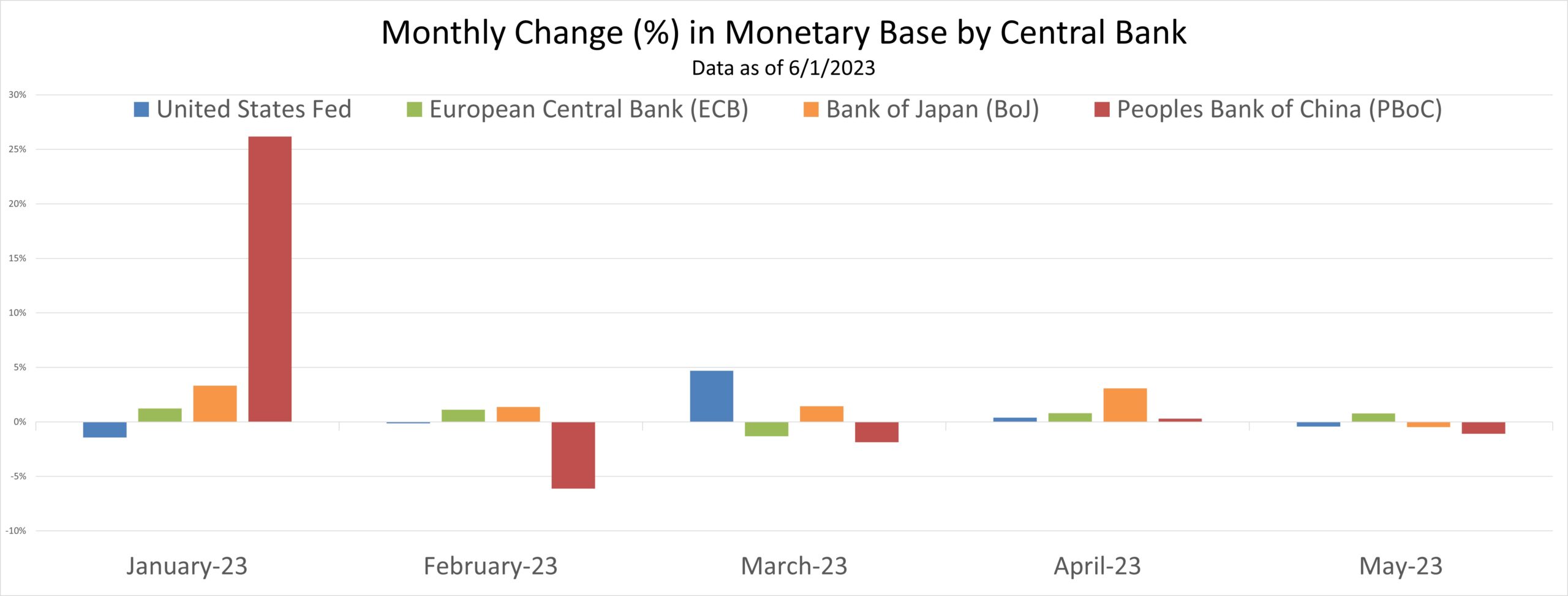

We challenge the conventional narrative that a craze surrounding artificial intelligence (AI) fueled the market. Rather, our analysis shows that Central Banks are adding liquidity even as they raise interest rates. This increase in money flowed to the riskiest assets.

By extension, evaluating the second half of 2023, liquidity flows will determine market performance as it has since 2020.

Markets in perspective: what’s happened since Q2 2020? Where do we find ourselves in the economic cycle and how to think about returns going forward within that context? Economic data and the broad market point to a strained late cycle economy facing inflation, higher interest rates, and tightening economic conditions.

Warren Buffet famously said that in the short run, markets are a voting machine but in the long term they are a weighing mechanism. What he means is that for long-term investors, economic tradeoffs and truths eventually determine the value of investable assets— we call them risky assets since all investing involves risk; it’s all relative.

Weird is the best word to describe the first half of 2023. What if we teleported back to January and I told you: interest rates would finish Q2 almost 6% above the previous year’s rate; a banking crisis would eradicate First Republic, Credit Suisse, and Silicon Valley Bank; and China would have trouble restarting their post Covid economy. Yet, despite this, the market would have one of its best first half performances of the past decade led by shares in Carnival Cruise Lines, Royal Caribbean, and Norwegian. Would you have believed me? Well, that among other things, is what happened. Weird.

So, what do we make of this? You may recall that I was writing optimistically at the end of last year and last quarter, that the rally was fueled by massive cash flowing into US markets from the Chinese and Japanese central banks; and this has continued. As you know, we systematically track global money flows as this lifeblood controls growth, inflation, and of course markets. While it may feel like there isn't much excess cash in the US, globally there is and it's still flowing into the US markets.

Source: Camelotta Advisors

Source: Camelotta Advisors

Copyright 2023 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...