Investor Commentary Q1 2025 Key Takeaways:Fasten your seatbelts. Markets react to uncertainty by exhibiting higher highs and lower lows which may feel catastrophic but presents opportunities to profit for those with the stomach.Beyond tariffs: the market is a leading indicator for deeper economic problems.Position for this new environment using advanced portfolio management processes. You can

Insights

Our insights into Markets, Investing, and much more.

What Happens to Your Bitcoin When You Die?

What Happens to Your Bitcoin When You Die? Imagine building a cryptocurrency fortune and having it lost forever after you die; odds are you’re closer to that outcome than you think. Many crypto investors overlook including their wallets in their estate plans. Even for those who do, adding the wallet to their will may not

Investor Commentary Q4 2024

Investor Commentary Q4 2024 Key Takeaways:Another double-digit year for stocks: broad-based rallies to a more selective and discerning market environment leaving us in a narrowing “trader’s market” especially around the AI theme.What effect could the election result have on the economy and investors? The new administration will have to negotiate with Congress and markets.The way

Investor Commentary Q2 2024

Investor Commentary Q2 2024 Takeaways: Putting 2024 in PerspectiveThe first half boom stalled out over worries about inflation, debt levels, and the possibility that the Fed will keep rates high for too long. The one bullish narrative centered around AI, specifically one company that seems to be capturing most of the spoils: Nvidia. Those who owned

Investor Commentary Q1 2024

Investor Commentary Q1 2024 Takeaways:A quarter defined by divorces: we saw a few important relationships break down with profound implications for the economy and markets. Most notably, interest rates broke their negative correlation with stocks, and we saw rate expectations rise along with markets.The Fed softened their emphasis on a 2% inflation target and instead

Investor Commentary Q3 2023

Investor Commentary Q3 2023 Takeaways:Framing returns matters: performance over the past couple of years can look good or bad in any asset class depending on what time frame you pick.Time horizons also matter because combining short termism with recency bias can lead you to make poor evaluations of performance, and therefore poor adjustments. Ultimately you

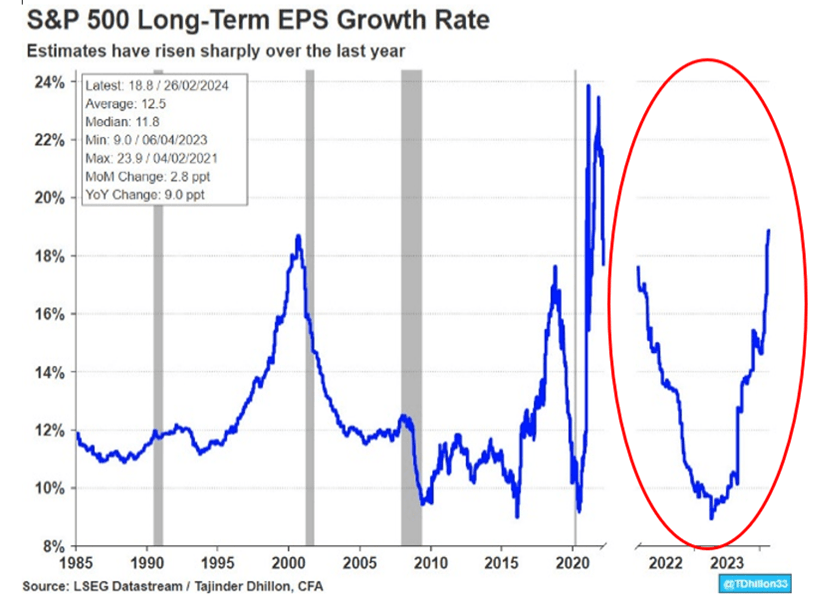

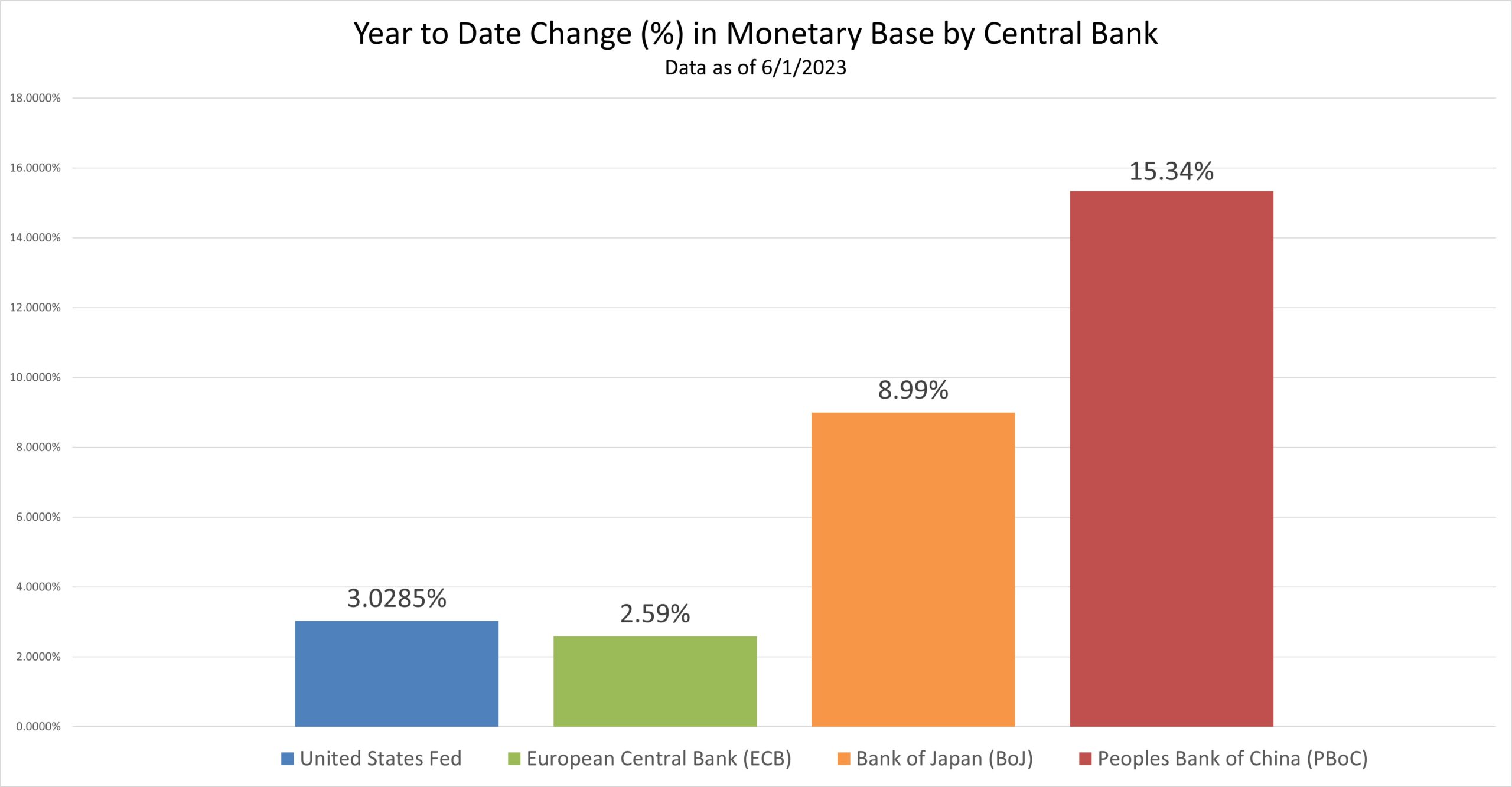

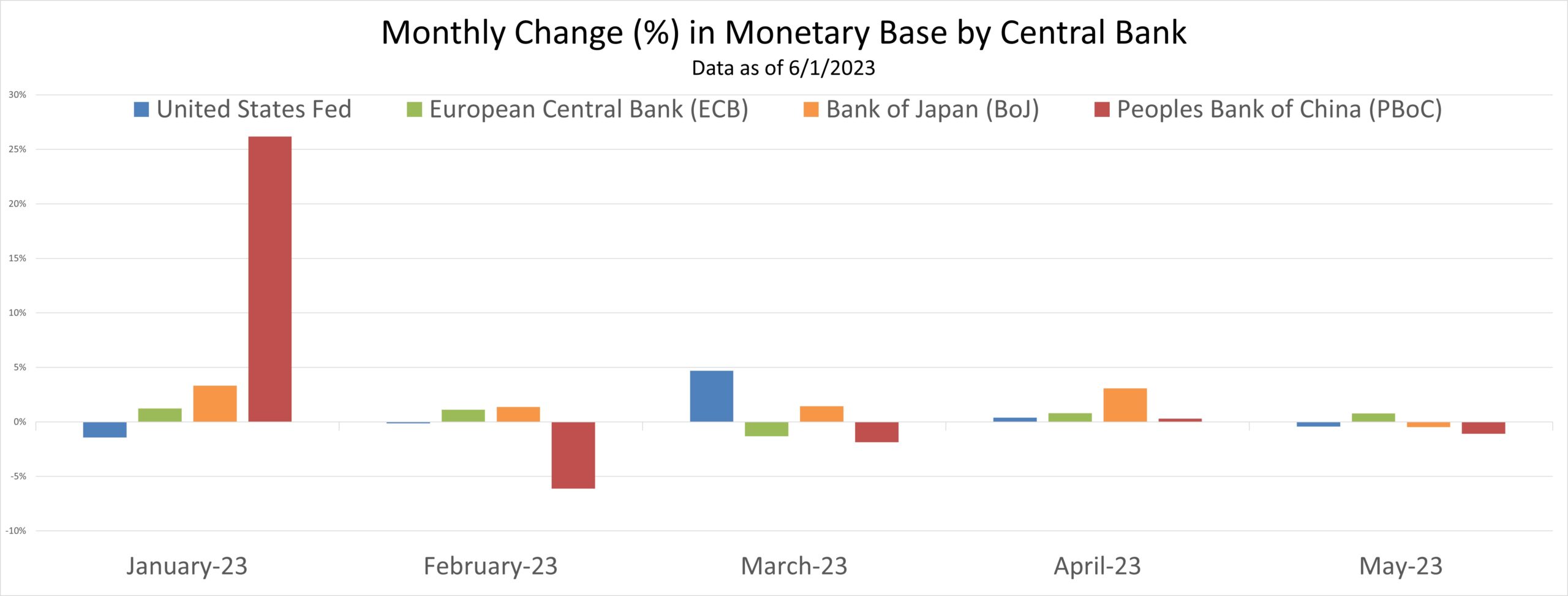

Investor Commentary Q2 2023

Investor Commentary Q2 2023 Takeaways:The story behind the story: last quarter’s performance was attributable to fewer than 10 stocks. If we strip them away, the markets tell a different story.We challenge the conventional narrative that a craze surrounding artificial intelligence (AI) fueled the market. Rather, our analysis shows that Central Banks are adding liquidity even

Can You Retire With 1 Million Dollars?

Can You Retire With 1 Million Dollars? The Wall Street Journal recently posed the question; can you retire on 1 million dollars? The article looks at 4 individuals and their retirement experiences in terms of how their savings held up and their lifestyle shifts since retiring. Surprisingly, the Journal doesn’t answer the most important question;

Investor Commentary Q4 2022

Investor Commentary Q4 2022 Risk markets rebounded off their lows last quarter enabling us to earn back some of the losses endured during the first 3 quarters of the year. The highest price posted by the S&P 500 was on the first day of 2022 and it was downhill thereafter, declining by almost 20%. The

3 Things You Didn’t Know About Tax Savings

3 Things You Didn’t Know About Tax Savings Taxes won’t go away in the new year, but some lesser-known facts could give you some holiday cheer. Here are 3 opportunities for tax savings that you may have overlooked: 1. Ring in The New Year with Lower Effective Tax RatesThe IRS is giving out New Year’s bonuses

Can You Retire With 2 Million Dollars?

Can You Retire With 2 Million Dollars? The Wall Street Journal recently posed the question; can you retire on 2 million dollars? The article looks at 4 individuals and their retirement experiences, in terms of how their savings held up and the lifestyle shifts they have made since retiring. But surprisingly, the journal doesn’t answer

Investor Commentary Q3 2022

Investor Commentary Q3 2022 In July, I said it would be hard to do worse in the past hundred years than Q2. It turns out that it was also hard to do better. Q3 was one to forget, ending about where it began. This year’s asset selloff is not due to a global pandemic or

Are Target Date Funds Really Helping Employees?

Are Target Date Funds Really Helping Employees? If you have a retirement savings account, you’ve likely heard of target date funds, or you might already be holding one.A target date fund is a mutual fund or ETF that invests assets to target liquidation for a certain event in the future. They are most used for

Everyone Said “Gimme More” in the Spears Conservatorship

Everyone Said “Gimme More” in the Spears Conservatorship Britney Spears’ conservatorship is one of the most notable to date, but it’s not only for her celebrity status. The case reveals some gray areas that could be relevant should you become involved in a conservatorship.What Is a Conservatorship?A conservatorship is an arrangement in which a court

Investor Commentary Q2 2022

Investor Commentary Q2 2022 Key Takeaways:Putting 2022 in PerspectiveOver the past 2 years, we enjoyed a huge increase in values. The “cost” of admission to this type of performance is the acceptance that markets like the S&P 500, have dipped 14% once a year on average. While things are down, investors don’t truly lose money

"Investors are swimming against the tide with one arm tied against their backs. The tide consists of taxes, fees, volatility, inflation and life events and the only time-tested tools at your disposal boil down to diversification, compound interest, and time.”

Dana Grigg

President