Longevity Planning is the New Retirement Plan

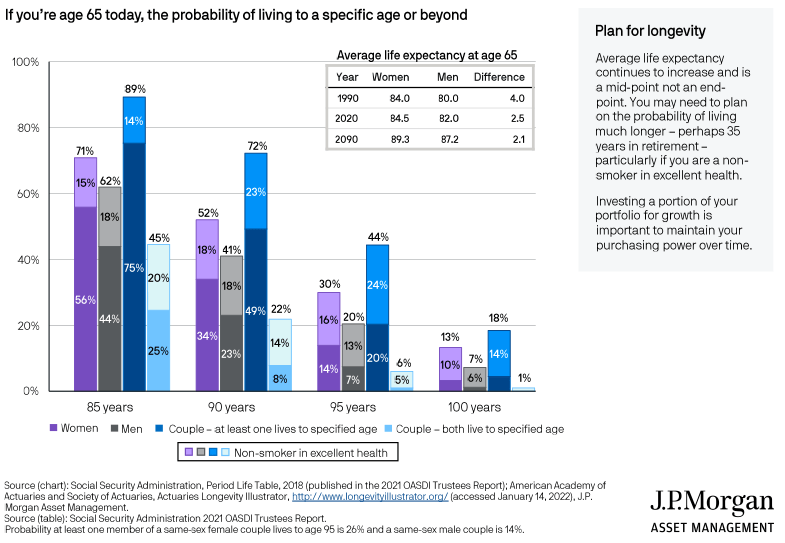

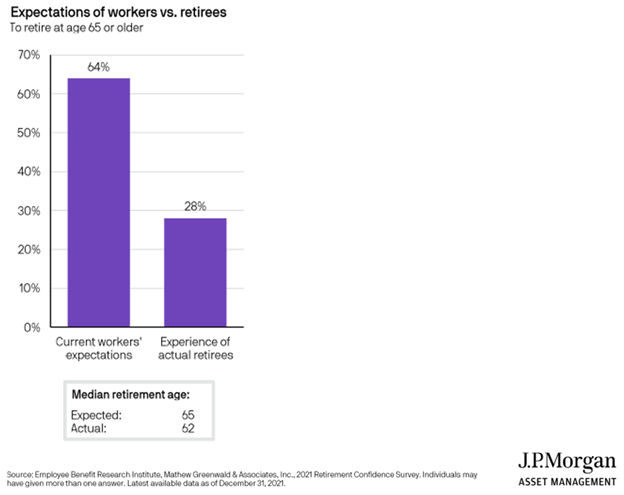

Along with longer lifespans, people are now retiring earlier too. Most people expecting to work until 65 actually stopped working at 62. Pushing their financial advisors to plan on at least 25 years of retirement, if not longer—we’ve seen some clients planning for 40 years.

When time horizons increase from a traditional 7-year retirement to 25+ years, we see clients’ goals and risk profiles change. This affects their planning needs and investment strategy. Another factor we now have to consider is the new definition of what it means to be retired.

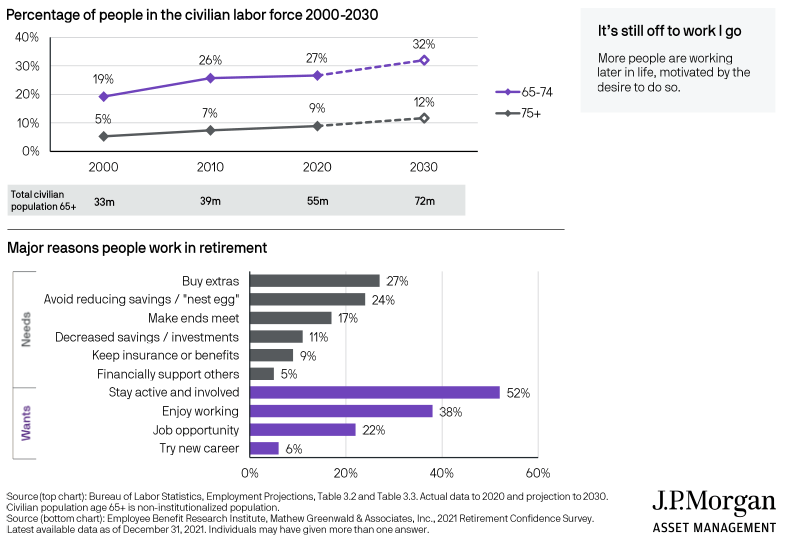

Contrary to the fact that people have stopped working earlier in life, the percentage of individuals 65+ in the labor force has gone up in the past 20 years and is projected to increase even more in the next decade—meaning retirees are reentering the workforce.

This phenomenon is contributing to the push towards longevity planning. A retirement date is no longer when someone stops working; instead, it’s the point at which someone stops working because they need to and starts working because they want to—or when they achieve financial freedom.

Almost 40% of retirees in the survey above said they kept working because they enjoyed it. We’ve seen many of our clients do the same; they ‘retire’ but continue working in some scope because they find purpose in their work, beyond just the paycheck.

For these reasons, financial plans need to get away from a simple retirement mindset and move towards longevity planning. This type of lifetime planning addresses the items that people look for in a retirement plan but also considers factors like increasing lifespans, tax implications of working longer, and the goals for your overall wealth.

Copyright 2022 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...