Does Medicare Provide Enough Coverage?

What is Medigap?

Medicare Supplemental Insurance or Medigap is a privately issued insurance policy that supplements the out-of-pocket expenses you face with Medicare. The policy is used to pay for things like deductibles, coinsurance, and copays you face through Medicare Part A and B—you cannot purchase a Medigap policy if you have Medicare Part C or Medicare Advantage.

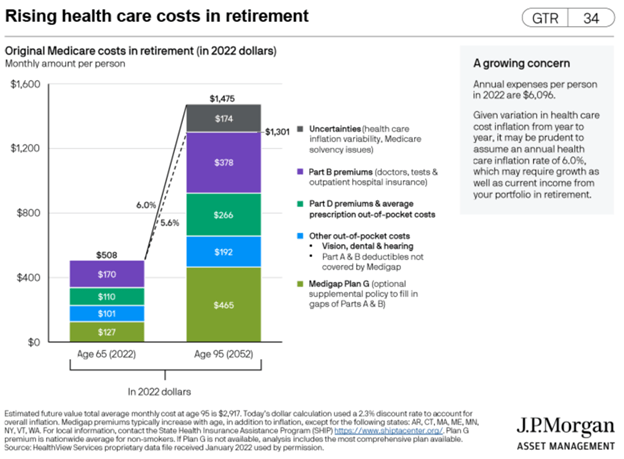

Medigap insurance is predicted to rise in cost over time. In the graph above you can see that currently premiums for these supplemental policies make-up 25% of retirees’ healthcare costs and it’s projected to grow to almost a third of healthcare costs, transitioning into the largest premium retirees will pay.

The projected growth of Medigap plans brings up a bigger question: does Medicare provide you with enough healthcare coverage?

The answer to that question will be different for everyone based on their coverage needs and ability to pay out-of-pocket healthcare expenses. Let’s look at the coverage options Medicare provides and some of the costs you are burdened with.

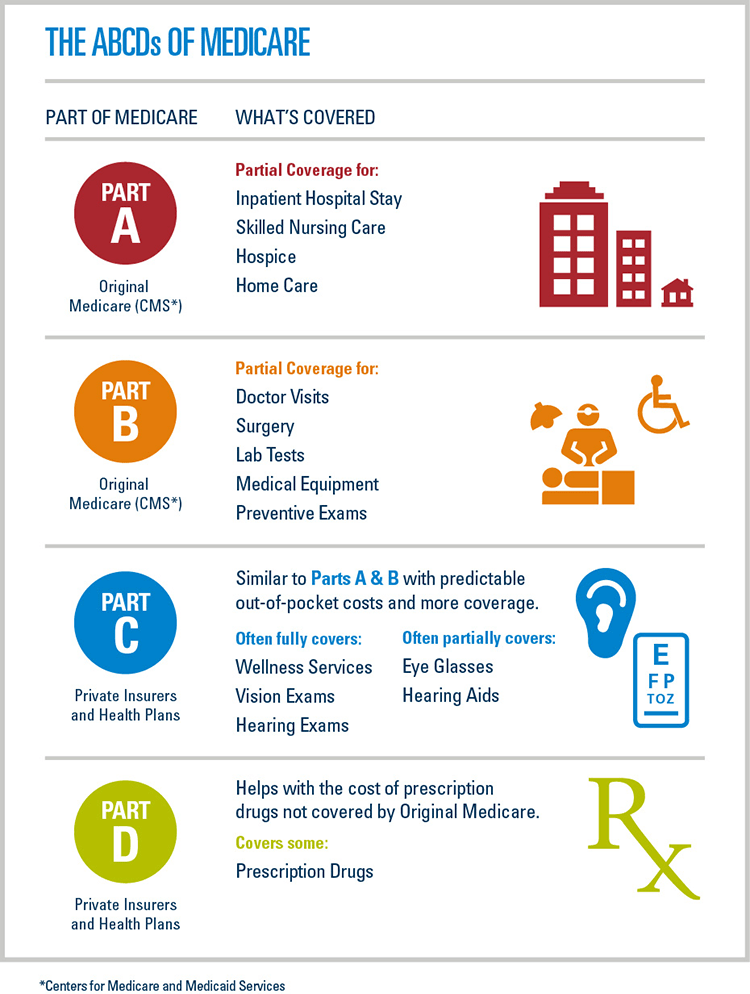

Medicare Part A

The first layer of Medicare is the hospital coverage plan. This provides partial coverage for inpatient hospital care, nursing facilities, home health care, and hospice care; but it does not cover 100% of the costs. Like most private health insurance, you still have a deductible, coinsurance, and a policy maximum–measured by the number of days in the hospital rather than a dollar amount. Most people do not pay a premium for Medicare part A, but you could pay up to $499/month1 depending on how much you have paid in Medicare taxes.

One item of note with part A coverage is the deductible. It’s not like the annual deductible you see with private health insurance, instead you pay a $1,556 deductible per benefit period1—which starts the day you are admitted and ends when you have gone 60-days without inpatient care. In other words, it’s possible to pay the deductible multiple times in one year if you have hospital stays within different benefit periods.

Medicare Part B

The second tier of Medicare is the health insurance piece. This again works like private insurance; you pay a premium, have an annual deductible, and coinsurance or copays. The 2022 deductible for Medicare part B is only $233, but you also have to pay a coinsurance of 20%.1 In return the policy covers most doctors’ visits, lab services, and hospital stays anywhere Medicare is accepted.

With part B the premium payment may vary based on your income. For 2022 everyone pays a standard monthly premium of $170.10, however an additional premium could be added to the base rate depending on your income for the past 2 years. This adjustment is called the Income Related Monthly Adjustment Amount (IRMAA). The maximum total monthly premium for part B is $578.30 for 2022.1

The combination of Medicare part A and part B is called Original Medicare. With this foundation you can also add on Medicare Part D and/or Medigap. Alternatively, you can enroll in Medicare part C which combines the multiple parts into one policy.

Medicare Part D

Part D is Medicare coverage for prescription drugs. This plan is issued by private insurers but follow rules Medicare has set. You pay an additional monthly premium for Part D and your out-of-pocket costs will vary based on the plan you choose.

Medicare Part D is often combined with Original Medicare (part A and B), creating a more holistic plan that provides hospital, medical, and prescription coverage anywhere that accepts Medicare.

Most Medicare part D plans have a gap in coverage known as the “donut-hole.” So, there are 4 stages of coverage to the policy:2

- Coverage begins and you must meet your deductible—up to $480

- After you’ve met deductible, you begin paying only copays until your total spend on prescription drugs reaches $4,430 (for 2022).

- Once the total spend is over $4,430, you have decreased coverage a pay a percentage of all drug costs until you reach a total drug spend of $7,050 (for 2022).

- When the total spend is over $7,050, you are no longer in the coverage gap, and the plan covers 95% of drug costs until the plan year ends.

Medicare Part C

This is known as the Medicare Advantage Plan which combines part A, B, and usually D—or another prescription drug plan—into one policy and adds additional benefits that Medicare does not cover like vision or dental. This plan is issued by private insurers that have been approved by Medicare; so, coverage, premiums, and out-of-pocket expenses will vary by plan.

Additionally, with a Medicare Advantage plan you are limited to in-network providers—which varies based on the plan you enroll in.

Blue Cross Blue Shield, What Does Medicare Cover?

What’s Not Covered?

Original Medicare does not provide coverage for is dental, vision, and hearing, but you may get coverage for these items if you select a Medicare Part C plan that includes these benefits. Additionally, none of the Medicare options cover long-term care, which is a costly expense. For these items you either pay out-of-pocket or you can purchase a policy issued by a private insurer.

Overall, Medicare provides many partial coverage options but nothing that will cover 100% of healthcare costs. This leaves many retirees with high out-of-pocket medical expenses—the ‘gap’ in Medicare coverage. Therefore, many people weigh the costs and benefits of Medigap policies to see if it could lower their health-related expenses.

Everyone has different medical considerations, which is why our clients’ financial planning process helps them determine the most cost-effective way to get coverage that aligns with their lifestyle. Get in touch with us today if you have questions or concerns about your future healthcare financial needs.

Copyright 2022 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Enter your text here...